Background

Håkan Jankensgård is an associate professor of corporate finance in the Department of Business Administration & Knut Wicksell Centre for Financial Studies in Lund University, Sweden. The Knut Wicksell Centre conducts financial research and collaborates with practitioners. Jankensgård’s course, Corporate Risk Management, teaches master’s-level students to come up with recommendations on risk management policy to a board of directors.

Course Project

For the assignment, Jankensgård instructs students that the board of directors are concerned about the firm’s derivative usage and want a review of it to support a new risk management policy. Students must then provide recommendations for the board based on an evaluation of a mapping of its risk exposures and a modeling of its current risk profile.

A specific group of students were given the example of Bonanza Creek Energy, an oil and gas company based in Colorado. The students were told this company had filed for Chapter 11 bankruptcy. The company had total sales of $192.1 million that year, with debt-to-equity ratio of 0.2, and net debt-to-EBITDA being 2.17 and an EBITDA of $59.5 million. Additionally, the firm had a hedging strategy, taking total losses of $16 million in their most recent quarter, and $22 million in the prior quarter.

Risk Exposure

Jankensgård next asks students to map out the fictional company’s exposures. This included quantifying market exposures, identifying two independent variables, and identifying the top five to ten non-market risk exposures, their probability of occurring within the next year, and their monetary impact.

For the Bonanza Creek example, the student group categorized risks into market and non-market risks, with the top five risks comprising two market risks – exposure to oil and gas prices – and three non-market risks – supply risk, pipeline infrastructure, and employee turn-over.

Håkan Jankensgård

Modeling with @RISK

With the exposures identified, the students next had to model the risk using @RISK. By using the firm’s financial report, they must explicitly model five financial quarters. They must also create measures of risk based on the firm’s financial statements while identifying negative consequences of volatility that have no corresponding upside potential.

The students assigned a normal distribution to represent uncertainty in the risk factors and were asked to ensure those modeled were also correlated using the correlation matrix feature in @RISK. The students assigned risk output functions to the lines in their model that they used to assess the firm’s risk profile. During the course, Jankensgård encouraged students to make use of @RISK resources, i.e. tutorials, videos, and examples, which can be found at Palisade.com.

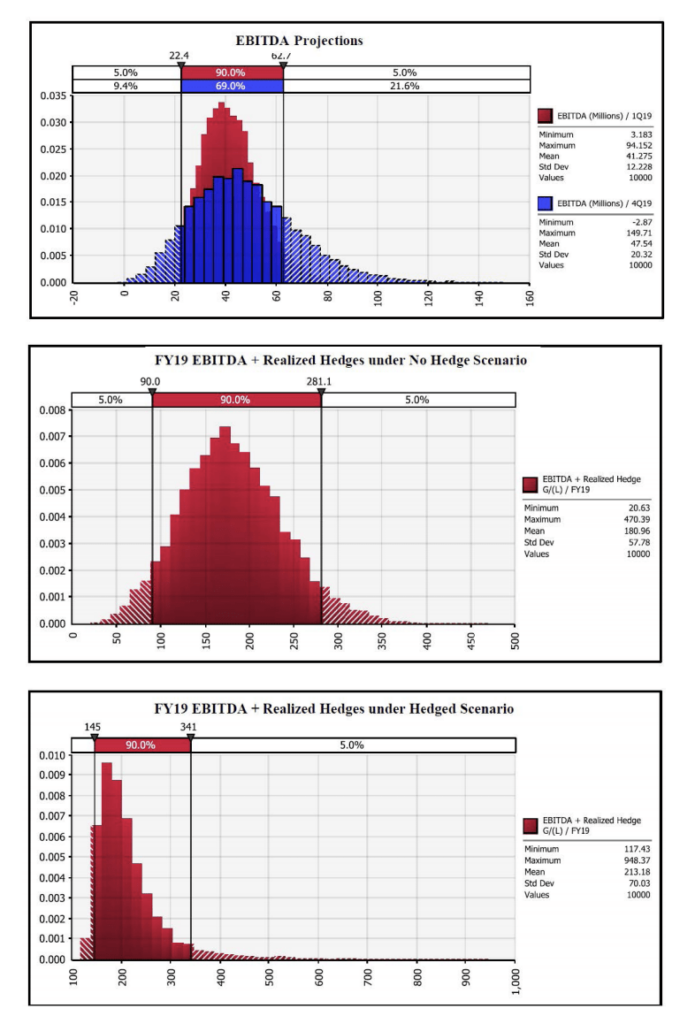

For the Bonanza Creek group, they ran 10,000 simulated scenarios and measured performance against the following measures: cash flow shortfall, exceeded debt capacity, and tripped covenants (i.e., scenarios in which their 12-month trailing Interest Coverage Ratio or Leverage Ratio fall outside the boundaries stipulated in the existing debt covenants). After running simulations, the students found that, in a case with no hedging of market exposure, Bonaza would experience a severe cash shortfall 1% of the time, exceed debt capacity 11% of the time, and trip the covenants 5% of the time.

After running the simulations on @RISK, the student group concluded that Bonanza Creek’s main risk is exposure to commodity prices, with the lion’s share being oil price risk. “If the oil price falls below a certain point for an extended period of time, the firm cannot continue to operate profitably,” the students concluded in their report. “The core business model and competence of Bonanza Creek lies in the exploration and extraction of oil and natural gas, not in commodity speculation. The operational risks are the risks the company should take on, while the downside exposure to oil & gas prices should be hedged away as it falls outside the company’s control and the expertise of the management team.”

The group also noted that their modeled forecast with the proposed hedging solution supports a modest CAPEX of $260 million.

The students proposed solution leaves the upside potential of the core business intact while financing the insurance through cash and the credit facility. The proposed strategy can therefore be seen as a refinement and more pure risk management strategy.

@RISK charts developed in Jankensgård’s class that depict the financial outcomes for Bonanza under certain circumstances

Benefits of @RISK

Thanks to @RISK’s modeling capabilities, Jankensgård’s students, including the Bonanza Creek group could analyze how these fictitious firms’ risks changed as a result of different financial management approaches, and also how the upside potential is affected by these decisions. “It quantifies the firm’s risk, and allows the students to assess the risk-return profile before and after a proposed policy change, which in turn lets them identify the optimal policy,” says Jankensgård. He notes that the normal and discrete distributions are the most commonly used in the course, and that a key feature used is the IF function in Excel to create quantitative risk measures when combined with simulations.

“This Corporate Risk Management course was a great success,” says Jankensgård, noting that master’s students rated the course the highest ranking in terms of usefulness for future careers of all courses. “The advantage is that students come away with an appreciation of the dynamic nature of risk, and a skill set to deal with that dynamic aspect of it, and which is exceedingly rare both in firms and at universities.