France is the largest country in Western Europe and the European Union (EU). With a population of roughly 67 million, it is the second-most populous country in the EU. Building and upgrading rail systems across this large and populous country is logistically challenging, requires large amounts of financing, and often involves complicated partnerships between public and private stakeholders. Before starting complex projects, it is crucial to evaluate the various risks that come along with large-scale infrastructure builds. Recently, a number of long-distance, high-speed rail projects were analyzed using @RISK to fully weigh the challenges each project faced. “@RISK allowed us to take all the risks into account and to assess the whole ‘Value at Risk’ for the project financer,” says Dr. Lionel Clément, who helped spear-head the analysis. Clément is an Associate at Transae, a consultancy in transport economics.

Rationing the Railway Risk

The project financer mentioned by Dr. Clément is Réseau Ferré de France (RFF), a state-owned company that owns and manages the French railway sector. “When a new HSL (high-speed line) project is going to be built, RFF will arrange for the capital expenditure financing, basing it on the tolls they expect to collect for the next 50 years, minus the operating costs they will have to support,” says Dr. Clément. To estimate the future tolls necessary for capital expenditure (capex) funding, RFF must estimate the expected willingness to pay by future passengers, and the train companies.

However, HSL projects often involve additional outside parties—namely, private companies, that sign on to a public-private partnership (PPP) arrangements. These involve a contract between the public sector and a private party, in which the two partners share in the cost and risks of the project. Frequently, one of the key differences in these contracts hinges upon which party takes on the traffic and revenue risks for the project. Traffic and revenue risks are crucial as they can determine both project costs due to maintenance and capital expenses, and project revenues thanks to user tolls. Thus, whichever party takes on traffic and revenue risks must have a clear understanding of the future challenges, as they will be liable to bear the brunt of the financial burden of the project.

In recent years, France has launched a number of PPP contracts to build high-speed lines (HSL). Current HSL PPP projects are:

- LGV Bretagne Pays de la Loire, which runs 182 km (113 miles) and will cost an estimated €3,280M (US $4.476M): PPP with no traffic/revenue risk transferred to private sector

- LGV Sud Europe Atlantique which runs 340 km (211 miles) and will cost an estimated €7,460M( US $1018.1M): PPP with traffic/revenue risk transferred to private sector

- LGV Controunement Nimes Montpellier, 80 (50 miles) km long and priced at €1,800M (US$2456M): PPP with no traffic/revenue risk transferred to private sector

Transae was tasked with helping RFF assess the different financing risks of previous PPP projects. They applied their “DEFIT” tool (Diagnostic Economique et Financier des Infrastructures de Transport), which enables the assessment of Value at Risk for each project by integrating all variables and correlations.

Dr. Lionel Clément

Transae

Conducting the Analysis

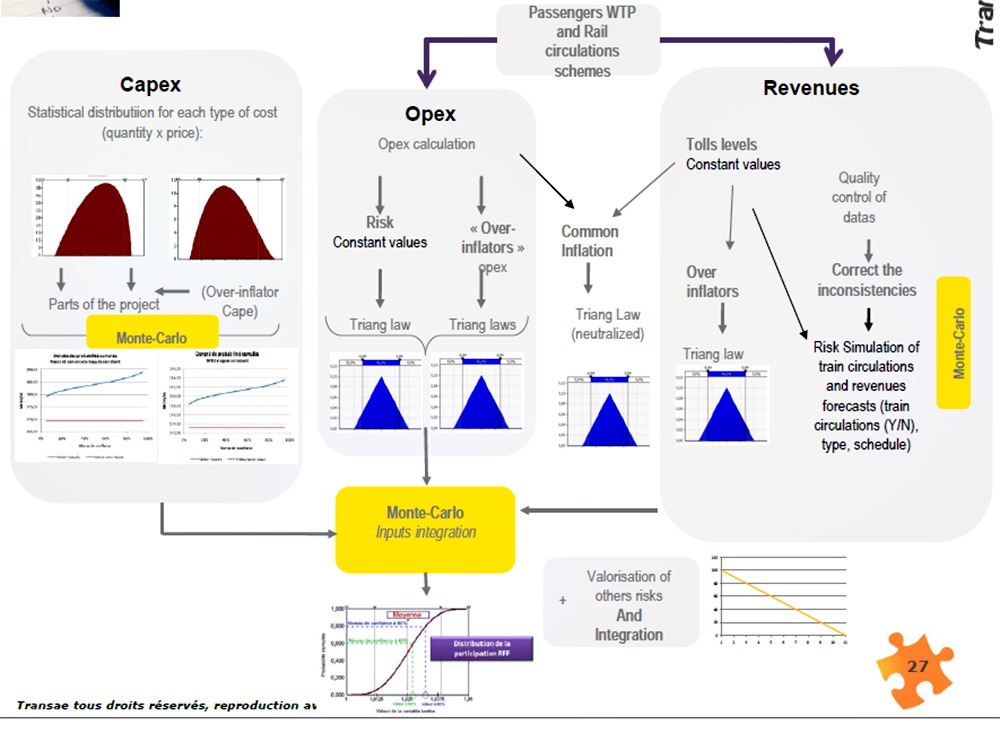

To evaluate the risk of a potential rail-line project, Clément and Jean-Eric Morain ran calculations that compared the project at hand with a reference situation (no rail-line project) over a theoretical period of 50 years. They relied on historical data and expert feedback on many existing French HSLs. The simulation showed the cash flow patterns over this theoretical 50 years, consolidating the project’s Value at Risk into one distribution that included all the different risks involved in the project, such as capital expenditures, operating costs, traffic and revenue risks, general and over inflation risks (linked to each budget item), as well as contractual and qualitative risks, such as interface and contractual risks.

These detailed data points on different cost risks, including passenger traffic volume and train circulation schedules, were used as inputs for the model.

Their key question when running the @RISK simulation was, which amount of financial risk (in Euros) is indicated for a defined confidence level, such as 80%? That value will be taken into account for project financing.

After running the simulation, Clément and Morain had a Value at Risk curve for the project with a 5% discount rate for the next 50 years.

Clément says that @RISK enabled the efficient analysis of huge amounts of varied data: “@RISK allows us to handle a huge quantity of data inputs, to calibrate lots of risk factors, to deal with correlations, and to conduct a large number of tests to stabilize the complex model developed for each of Transae’s high speed rail projects.”