It is common knowledge that the primary way to create real wealth is to make your money ‘work’ for you - i.e., investing. For high net-worth individuals with a long-term investment horizon, investments typically go beyond merely buying stocks and bonds – their portfolio management strategies often involve more complicated and less liquid investments. This can include ‘direct investment,’ according to Matthew Rosenberg, Managing Partner of RoseCap Investment Advisors.

Direct investment is the purchase of a controlling interest in an investment, such as a business or real estate. The benefits of direct investment include higher potential returns, and additional diversification to a portfolio, among others. Despite the potential for high rewards, these types of investments involve a number of uncertainties. For many of Rosenberg’s clients, the uncertainties may include future sales growth, capital events, vacancy rates, market rents, etc. Assessing the uncertainty around these key variables is instrumental in making decisions on whether or not to take on these direct investments.

Putting Palisade Software to Work

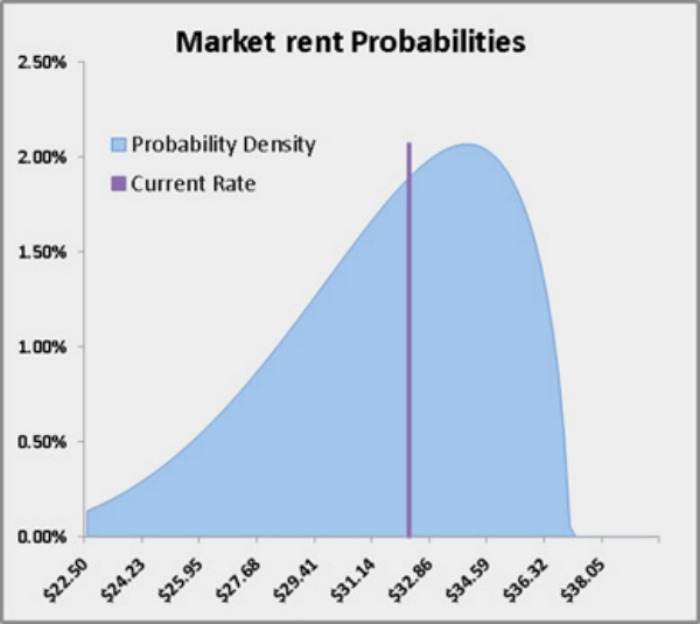

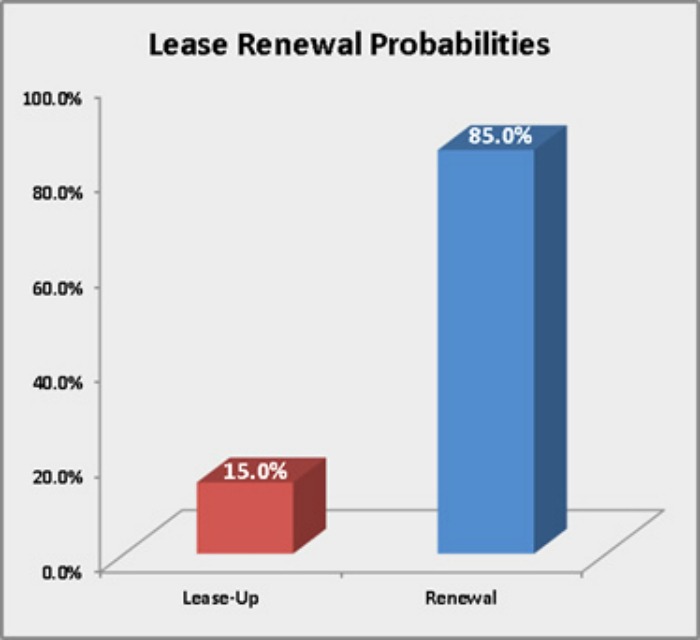

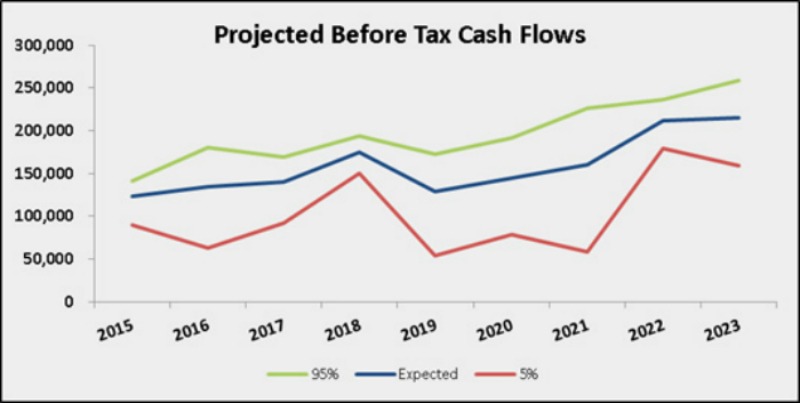

In order to advise clients, Rosenberg looks to @RISK to help analyze risk levels of particular direct investment opportunities. “I use Palisade’s software in many of the investment and valuation processes of my business,” says Rosenberg. One of the best examples of @RISK’s usefulness is in analyzing the risks around commercial real estate. “There’s a lot of variables that are very important in the valuation of the property that are also highly uncertain,” he explains. These include rent rates, lease renewal probabilities, interest rate changes, capital expenditures (such as needing to replace a roof or air conditioning system), and many others. Because all these variables could combine in a myriad of ways, Rosenberg chose to use @RISK to better illustrate the range of outcomes to his client. “Our models use @RISK to ultimately give us a dispersion of values and a risk assessment of the property rather than one single number of what the investment is worth.”

In the case of a capital replacement (i.e. new roof), RoseCap uses @RISK to run a simulation that models the time frame in which their client would have to make that replacement. This involves random iterations showing replacement in a range of future years (i.e. 10-, 15-, or 20-year marks). While some capital events are expected, others may be unexpected. Simulations are also used to incorporate the impact of unexpected capital events--such as repairs from an accident or broken pipe. These more unusual events are also incorporated into the models. “I actually enjoy watching the simulations and reviewing the results,” says Rosenberg. “As you run each iteration of the simulation on Palisade’s software, it will show you an unexpected capital event occurring in one iteration, but possibly not in the next, essentially randomly throwing these unexpected capital events around--it helps you really understand the potential for an investment to produce long term cash flows, while still considering events that many fail to account for."

Rosenberg says that @RISK is instrumental in revealing the true risks and benefits to direct investments such as real estate, and that often times investors are unaware of exactly what kind of risks they’re taking on with such purchases. “For example, many people buy rental properties as an investment and expect to make a fixed profit each month on the property; they don’t take into account the uncertainties, such as the tenant not making a rental payment, that may adversely impact the cash flows from that investment.”

Once RoseCap has performed an analysis on a direct investment for a client, they have the ability to incorporate the future performance of that investment into the total portfolio (or net worth) of the client, along with the client’s other investments. This provides a total net worth risk assessment for RoseCap clients. According to Rosenberg, “@RISK software has allowed my firm to take financial planning and risk assessment to a whole new level.”

Matthew Rosenberg

Managing Partner, RoseCap Investment Advisors

Reasons to Use @RISK

While Rosenberg has used other risk analysis programs to help his clients with investment opportunities, @RISK is his tool of choice thanks to its flexibility. “@RISK works within Excel and this allows us to shape or alter a financial model in any way necessary,” says Rosenberg. “There are other Monte Carlo simulation programs and softwares out there that are specific to a certain investment or process, but they don’t allow for customization. You end up taking a client’s situation and trying to cram it in a one-size-fits-all box that is subject to a multitude of exceptions and assumptions. This renders the program’s output unusable in reality. With @RISK, we can adapt our analysis to meet any special circumstances of a client or investment scenario.”