To support economic decisions around power plants, L. E. Peabody & Associates, Inc. develops the “real option” value for various types of power plants, including coal-fired and natural gas-fired power plants. Real option valuations are used by existing or prospective owners of power plants to support acquisition, divestiture, development, or retirement decisions. Owners of power plants also use real option valuations to support capital decisions, such as the installation of environmental controls, the expansion of plant capacity, or equipment to improve efficiency.

Real options analysis is very similar to the valuation of financial call and put option. A financial call is an option contract that gives the owner the right but not the obligation to buy a specified amount of an underlying security or commodity at a specified price within a specified time. Likewise, a financial put is an option contract that gives the owner the right but not the obligation to sell a specified amount of an underlying security or commodity at a specified price within a specified time. A real options analysis differs from a financial options analysis in that, rather than valuing variations of calls and puts on financial derivatives, real options analysis values “real life” calls and puts related to assets or capital decisions.

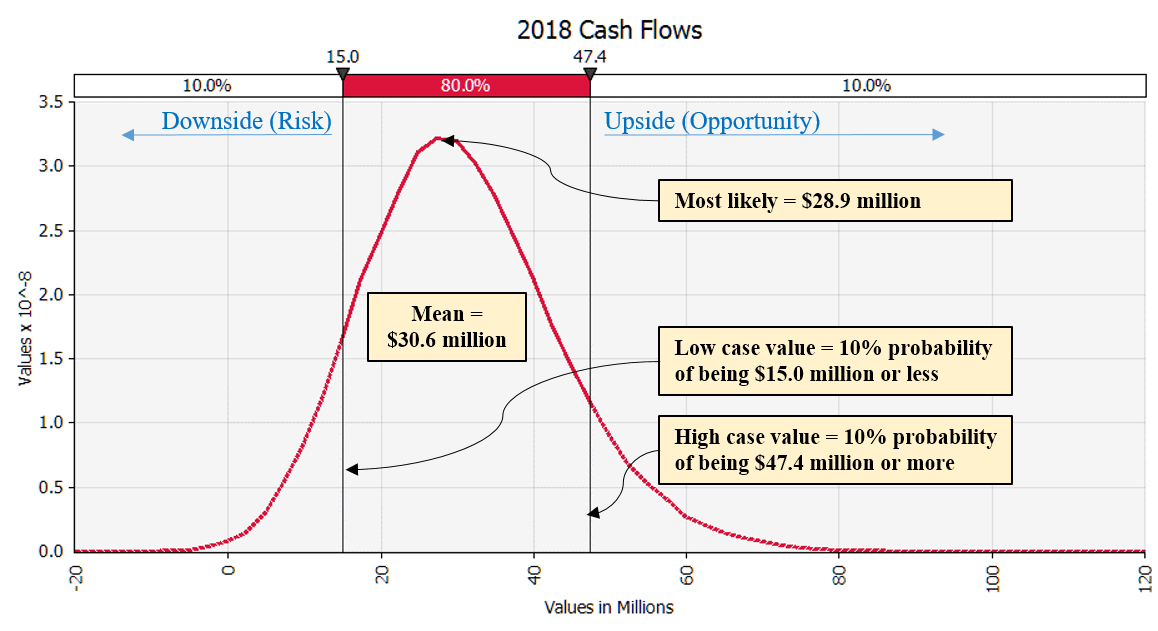

The firm also develops a power plant’s risk profile in the form of a probability distribution so that owners of existing power plants can understand the range and probability of possible values related to a decision. Asset value for a power plant reflects the summation of discounted free cash flow forecasted for the life of the asset. Power plant risk profiles can reflect a range of forecasted free cash flows over the life of the asset, or just free cash flows for a specific year.

Both a power plant’s asset value and risk profile are primarily a function of the value of the plant’s output (electric power) and the cost of the plant’s input (fuel). Generally speaking, if the market price for power is more than the power plant’s market price for fuel, the power plant operators will turn on, or “dispatch” the power plant to capture positive margin (i.e., revenues less variable fuel costs). “The challenge with forecasting power plant cash flows is that future market prices for power and fuel are uncertain,” explains Brian Despard, Vice President with L. E. Peabody & Associates, Inc. “This price uncertainty, combined with a power plant operator’s inherent option, without obligation, to start and stop a power plant to capture positive margin, creates a challenge for calculating a plant’s asset value and risk profile.”

Approach

L. E. Peabody & Associates, Inc. uses Palisade’s @RISK product to conquer the challenge of measuring a power plant’s real option value and to define a power plant’s risk profile. The firm applies @RISK’s Monte Carlo simulation functionality to simulate a power plant’s economic dispatch into uncertain power and fuel prices.

The steps taken by L. E. Peabody & Associates, Inc. to calculate power plant asset value and risk are as follows:

- Start with a power plant financial planning model that calculates forecasted cash flow.

- Identify components affected by power and fuel market price uncertainty (i.e., power revenues and fuel cost).

- Model economic dispatch decision. (Note: for purposes of the dispatch calculation, forecasted monthly power prices are broken out into hourly prices based on historical price shapes.)

- Model prices and volatilities to be used for @RISK uncertainty variables in the dispatch decision.

- Add prices and volatilities into @RISK uncertainty variable formulas. (These will be the prices that then flow into the modeled dispatch decision.)

- Correlate @RISK uncertainty variables in modeled dispatch calculation.

- Identify and designate model output (i.e., summation of discounted cash flows) as @RISK output variable.

- Run @RISK simulated dispatch decision with correlated @RISK uncertainty variables.

With each sampling iteration performed by the @RISK simulation, power and fuel prices are sampled, then pushed through the dispatch calculation. Each iteration’s positive dispatch margin, if any, then flows through the power plant planning model to arrive at free cash flows for that iteration. All the iterations solving for free cash flow based on sampled market prices for power and fuel are combined into a probability distribution of possible power plant free cash flows. This distribution and accompanying results show the expected “real option” value (or mean value) for the power plant along with a range of possible valuations for the power plant. Within this range, values below the expected value reflect downside risk and values above the expected value reflect upside opportunity. The chart below shows an example of one year of a power plant's value and risk profile resulting from an @RISK model run.

Brian Despard

Vice President, L.E. Peabody & Associates

Applications

The quantification of a power plant’s real value and risk profile can be used for several activities commonly undertaken by companies involved with power markets. These activities include:

- Support for mergers and acquisitions;

- Retirement planning;

- Development of hedging strategies;

- Valuation of commodity contracts with volume and price optionality;

- Evaluation of portfolio affect for fleet of power plants; and

- Evaluation of capital expenditure impact on asset value.

Using @RISK

For Despard, @RISK is a go-to tool for the kind of analyses described above. “@RISK allows our firm to easily and comprehensively develop real options analysis for our projects that involve market uncertainty,” says Despard. “As an Excel add-in, it integrates seamlessly into our various spreadsheet models. @RISK’s selection of distributions and functionality provide us with more than enough flexibility to develop our quantitative analyses.”