Dave MacAdam, Senior Manager of Innovation Strategy at Novelis, relies on the DecisionTools Suite of products to value high-risk research and development (R&D) projects. His process brings a new level of rigor and precision to the company’s business-as-usual approach to evaluating R&D risk. Through working with different stake-holders and experts across Novelis, MacAdam has started to introduce quantitative analysis to their R&D process, providing more opportunity to optimize their R&D project portfolio.

Novelis, the world’s largest aluminum rolling and recycling company, is a global leader in rolled aluminum production, beverage can recycling and automotive sheet production. The company produces aluminum products for packaging materials, automotive and transportation companies, as well as architecture and building. Novelis has 25 plants throughout 11 countries, employing 10,900 people, and has research and technology (R&T) offices in the USA, Germany, Switzerland and South Korea. Although a successful global innovator, Novelis’ process for evaluating new R&D projects previously did not incorporate a quantitative system for risk assessment.

“Within our R&T department, there was previously little to no structure put around the risk evaluation of projects,” says MacAdam. “The process was perfunctory and overly reliant on input from the commercial side. While commercial input is necessary, we found more information from the scientific side of the company was needed to accurately assess risk and more integration was needed between those two schools of thought.”

Introducing a New Approach

In his role as Senior Manager of Innovation Strategy, MacAdam set out to bring a new level of precision and accuracy to the risk evaluation process. Using @RISK and the DecisionTools Suite, MacAdam introduced a method in which models could be built that incorporated all assumptions from the different Novelis teams—commercial and scientific combined.

To start the evaluation process, MacAdam sat down with project leads, asking them to map out key decision points and key risk reduction points within each project. Through these conversations, MacAdam was able to capture what the risks were, as well as the leads’ predictions on the chances of the worst case, best case and most likely outcomes for each stage of a project.

“By going through this process, I was able to refine the assessment of the risk of each project from the project leads themselves,” says MacAdam. “This becomes an integral part of our risk assessment process and portfolio optimization.”

MacAdam also leverages what he calls an adaptive discount rate (ADR), which is a measurement developed by Mike Pellegrino at Pellegrino and Associates, a firm that specializes in intellectual property valuation.

The ADR incorporates Novelis’ target rate of return (also known as the “hurdle rate”), the holding period and the predicted success at each stage of a project. The target rate of return is usually made standard across an organization, while the holding period quantifies the period of time a company is willing to allow for that desired return to materialize.

“The holding period reflects an organization’s tolerance for risk and its patience for research,” says MacAdam.

Lastly is the success rate. MacAdam works with the technical community at Novelis to create a probability distribution for the success of each stage of a project. All these data combine to produce a risk-adjusted discount rate, which allows you to get a more accurate Net Present Value (NPV) looking forward to each stage of a project.

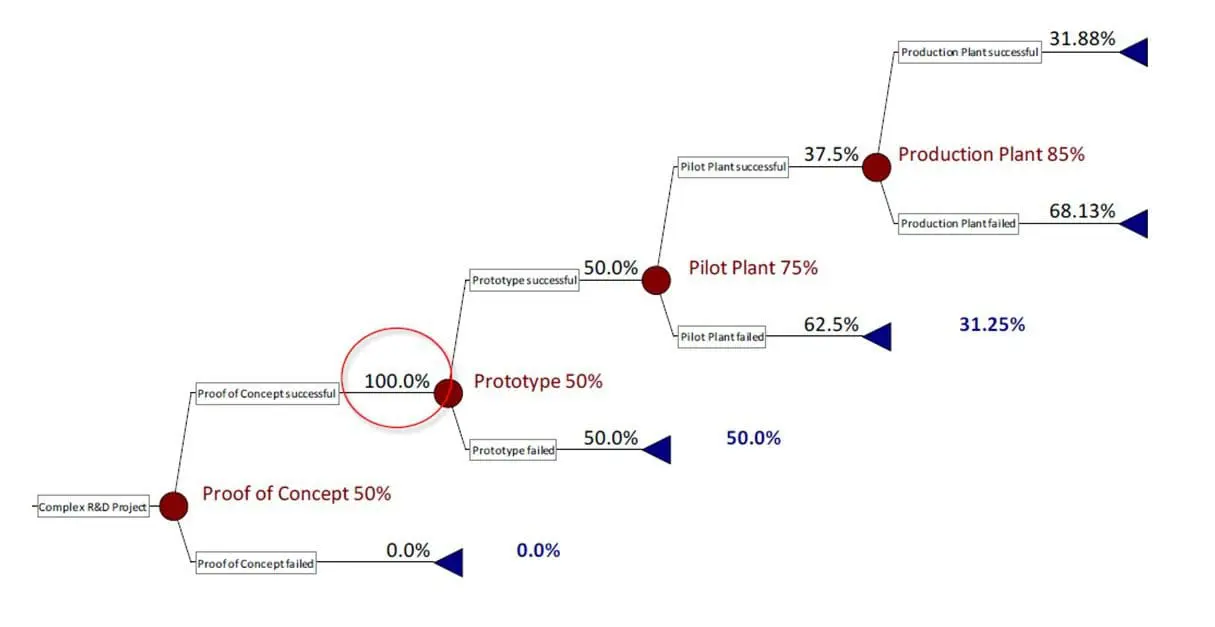

After determining the risks associated and the key decision points with each project lead, and identifying the different cash-flow stages of the project—such as prototyping, pilot plant and production, MacAdam then looks at the risk of each decision point and cash-flow stage of the project. He explains that the risk at each point compounds with the other points downstream, thus the importance of carefully evaluating each segment of the process within any given project.

“I’m big on risk retirement,” says MacAdam. “If you can retire risk, that makes the chance of success greater as you move forward—all your downstream risks get lower.”

If, for example, the prototype stage of a project goes through with 100 percent success, it reduces the risk of the pilot-production stage, and so on. To illustrate how this compounding works, MacAdam uses PrecisionTree to show project leads how each stage of a project influences the next.

Compounding risk/success rates for each stage of a new project

Senior Manager of Innovation Strategy, Novelis

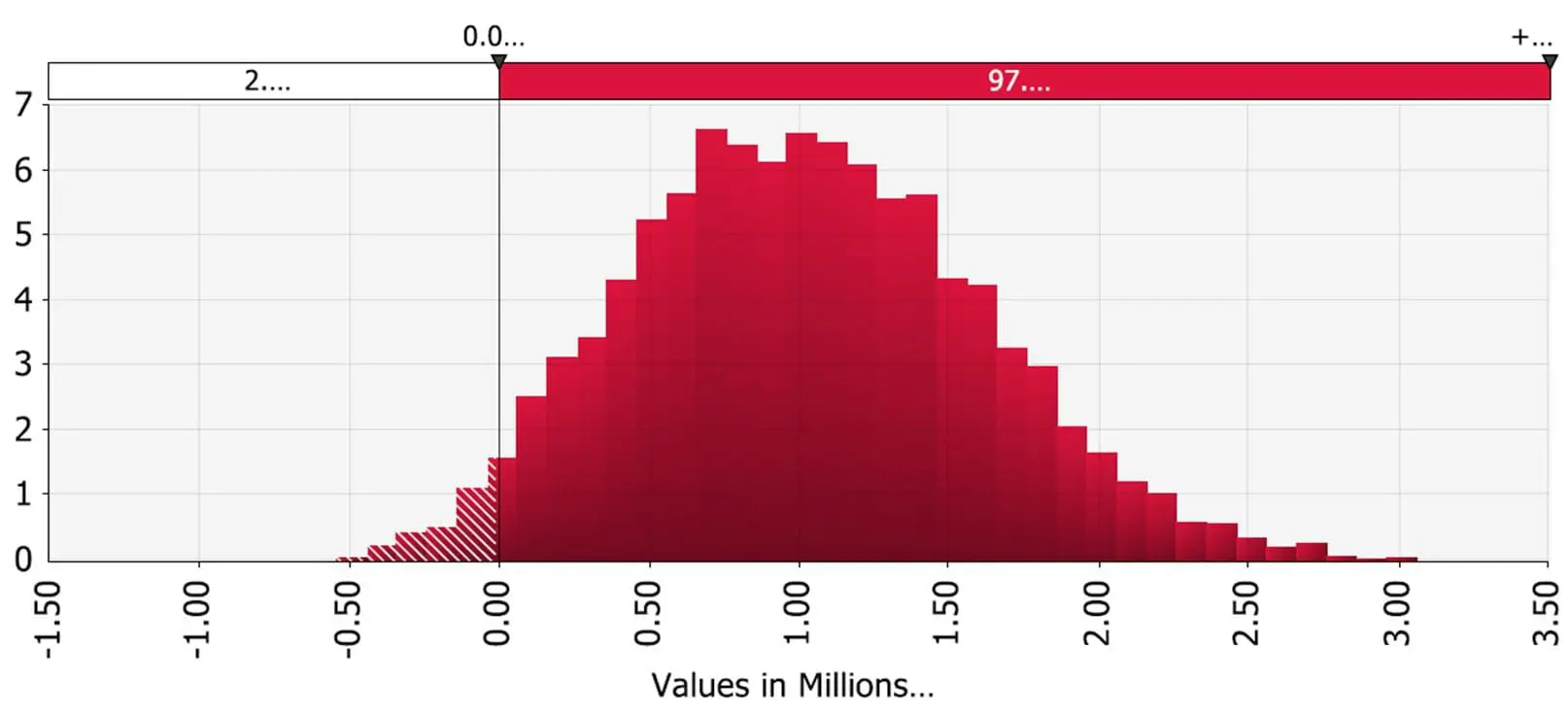

MacAdam turned to another Palisade product, @RISK, to get probabilistic distributions of key outcomes such as NPV for a project, tailoring the output graphs to show data that would be most relevant to his stakeholders.

Distribution of NPV for a proposed new venture

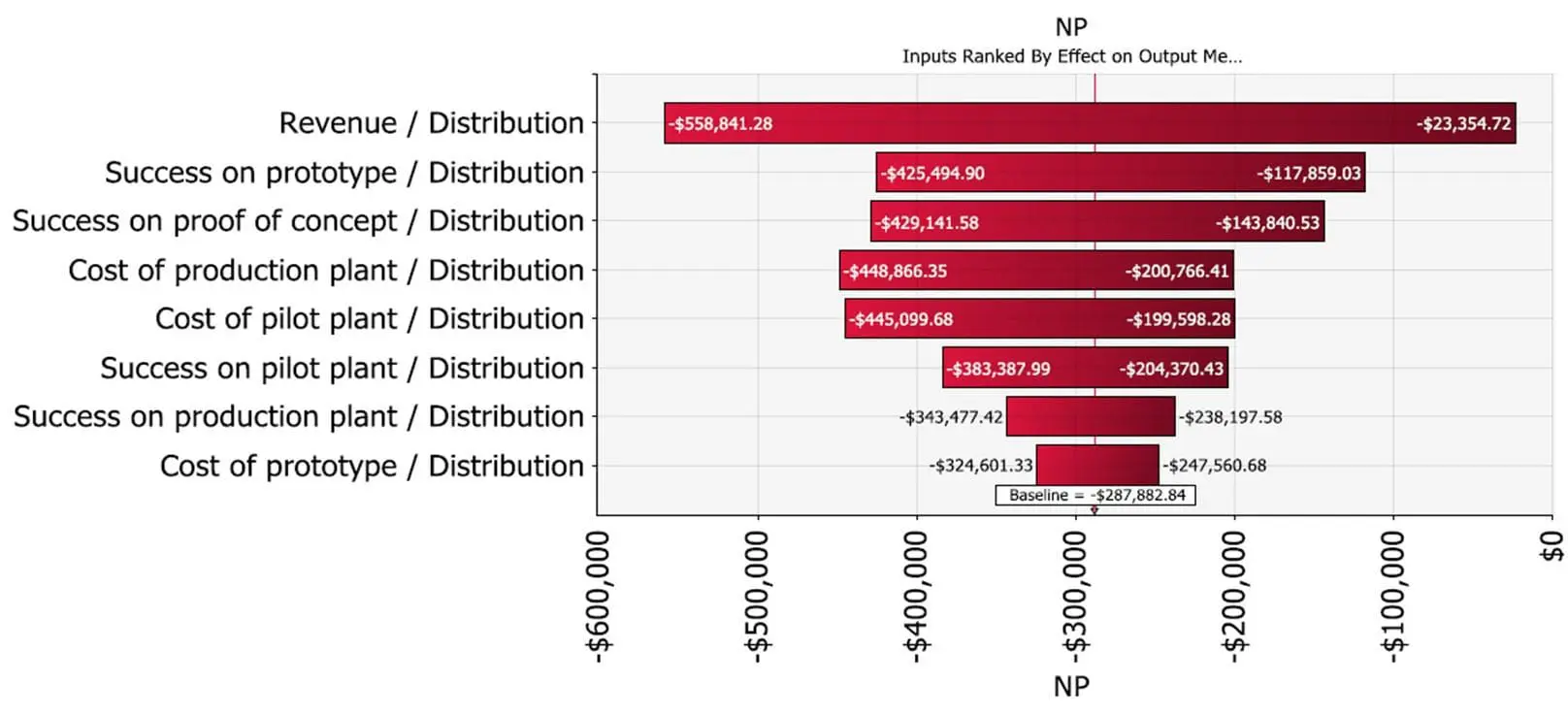

“These graphs make explaining the risk of a project easier,” MacAdam says. “In particular, @RISK’s tornado graph feature allows us to take the inputs from all the different participants on a project —from R&D, operations, marketing, etc.— and articulate what the biggest risks are in a hierarchical way. It’s an opportunity to challenge people’s assumptions and get at the heart of the real risks in a project.”

MacAdam gave the example of analyzing a new process being developed to enhance the efficiency of Novelis’ recycling process. After speaking with the project lead, MacAdam included several variants of scientific results from the research phase of the process. Thanks to this careful inclusion of data, the model showed that the entire success of the project hung heavily on the outcome of just a few specific technical tests.

“We realized in order to reduce risk, our researchers needed to do more testing,” says MacAdam. “We really couldn’t have much confidence in the business model without first having more confidence in the scientific measurements.”

Thanks to this software, MacAdam has been able to demonstrate to key decision makers which areas contribute most to a project’s overall risk, often revealing areas underestimated in their significance.

Tornado diagram illustrating the hierarchy of the most impactful risks for a project

The Beginning of a New Risk-Aware Era

According to MacAdam, this method of parsing out and analyzing the risk of each step in a proposed project has started small, ensuring the foundation is set and kinks are worked out before embarking on a larger rollout.

“Right now, we’re implementing this process on a project-by-project basis, mainly using it to assess the risk / return of specific R&D projects,” he says. “But the vision is to ultimately have it assess the relative value of projects—to help us decide between projects and see which ones to keep active. This system is becoming an essential part of our portfolio management and we anticipate it to have a significant role in our ‘go’ / ‘no-go’ decision making in the future.”

The Palisade software has been integral to the success of this new approach.

“@RISK enables us to speak directly with the information holders, have them verbalize their assumptions and then work with us to model it into a risk assessment that is truly useful—it’s an incredibly powerful tool,” MacAdam says. “Our researchers are now having conversations about their estimations, rather than being forced to enter a number into a box—which had been the previous approach to gathering and ranking risk data.”

MacAdam’s favorite aspect of using the product? How easy it made communicating results to stakeholders.

“We’re all making sausage, and no one wants to see how it gets made. The more succinct and clear you make those graphs, the more effective the decision-making process can be.”