In a volatile industry sector, large energy companies are well-versed in understanding and modelling business risks such as oil and power prices to optimised insurance spending. Alesco identified alternative future strategies for the financing and transfer of key risks, using Palisade’s risk analysis tool @RISK.

Alesco Risk Management Services Limited (Alesco), based in London, is an independent energy insurance broker and risk management consultant providing insurance and risk management solutions to the global energy industry. The company provides risk management, risk consultancy, and risk transfer services for clients encompassing upstream or downstream operators, drilling contractors, and traditional or alternative producers of power.

As part of their group structure and risk management strategy, many large oil and gas companies establish their own insurance subsidiary. These entities, called captive insurance companies, help manage the overall group risk. Due to the way in which they manage reserves, the captive can typically afford to retain higher risks than individual operating companies or business units.

Alesco works with these companies to determine how much risk they should retain in the business unit, how much should reside with their captive(s) and at what point they should transfer the excess or catastrophe risk to local and international reinsurance markets.

Weighing the Options with @RISK

To help its clients develop an informed risk management strategy, Alesco uses @RISK to design models that forecast future insurance losses. This enables alternative insurance structures to be tested to see how different balances of business unit retention (usually a simple deductible or excess on the policy that will be applied before any insurance claim is made), captive retention, and, beyond that, commercial insurance, affect premium levels and capital requirements. The objective is to find the optimal structure that balances an acceptable premium cost with the client’s financial ability to retain risk, and its appetite to do so.

A number of factors can influence the decision, including:

- Financial and cash flow considerations

- Types of coverage required, with these usually falling into the property or liability categories. Property claims, for example, after a fire, have a short-term impact on cash-flow as the damage and repair costs can be quickly assessed. In contrast, liability covers major events such as oil spills, the repercussions of which will usually last for many years.

- Types of assets covered and their location

- Loss history of the organisation

Regulatory regime of the client and location of the captive. e.g., those located within the EU must adhere to the region’s more complex regulatory environment. - Capitalisation requirements – i.e. the minimum and also target level of capital that the owner of parent company will be required to commit to operate an insurance company and write an agreed level of premium.

- Target Return on Capital, often described as the ‘hurdle rate’ if the captive is a new start up subsidiary company that can be viewed as competing against other group projects for any available investment capital.

- Risk of insolvency / recapitalisation. Under the EU Solvency 2 insurance regulation directive, as well as other ‘risk based’ capital models, a captive will need to demonstrate it has adequate capital to withstand a 1 in 200 year loss scenario, etc.

- Alternative reinsurance protection, e.g. multi-line multi-year. In addition to annual reinsurance contracts, a risk modelling approach using @RISK can be used to illustrate the value of more complex products, such as multi-line multi-year contracts. For example, it may be necessary to determine the reinsurance structure that will deliver the highest level of equity in three or five years’ time with a ‘downside’ exposure or possibility of recapitalisation of below 2%.

Partner, Alesco Risk Management Services Limited

Loss forecasting with @RISK

Alesco first works with the client to undertake a detailed loss forecasting exercise. This will typically comprise:

- Analysis of the frequency of claims by type (benchmarked against overall industry figures)

- Review of the severity profile of claims (also compared against industry loss data)

- Analysis of the total (aggregate) cost of claims, allocated by layer of insurance (i.e. internal, captive or external risk transfer)

- The uncertainty inherent in the losses by layer. (For events at the more catastrophic end of the loss scale, less data is available, making results less reliable, resulting in a bigger variable in how likely an event is to happen. The loading applied to the long-term average costs of claims is therefore higher.)

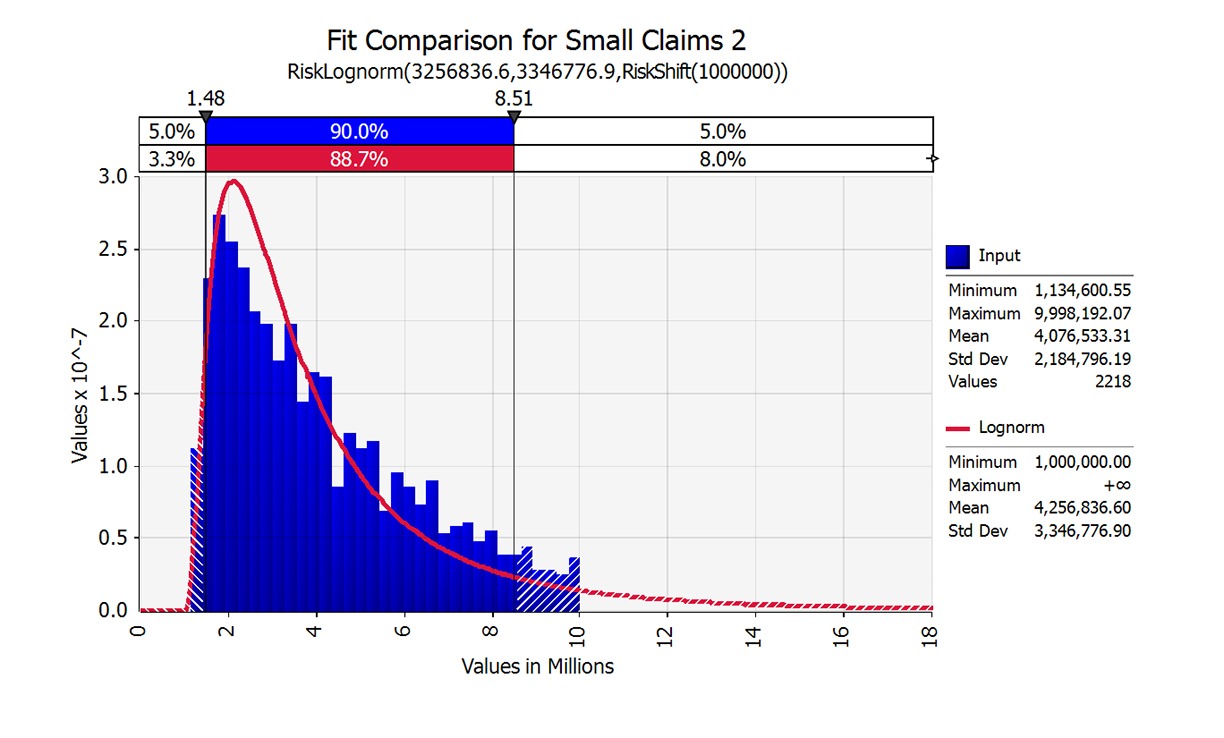

The next step is to determine how much risk a client should retain with its captive. Alesco fits statistical models to historical loss data, obtained from both the specific client and wider industry data (as above). @RISK is used for Monte Carlo simulation, with the output being graphs that show the projected long-run average retained loss cost for the client (captive) and the volatility around this average (the 95th percentile or worst year in 20 position, for example). i.e, both the average level of future losses and the variation around this average, can be estimated.

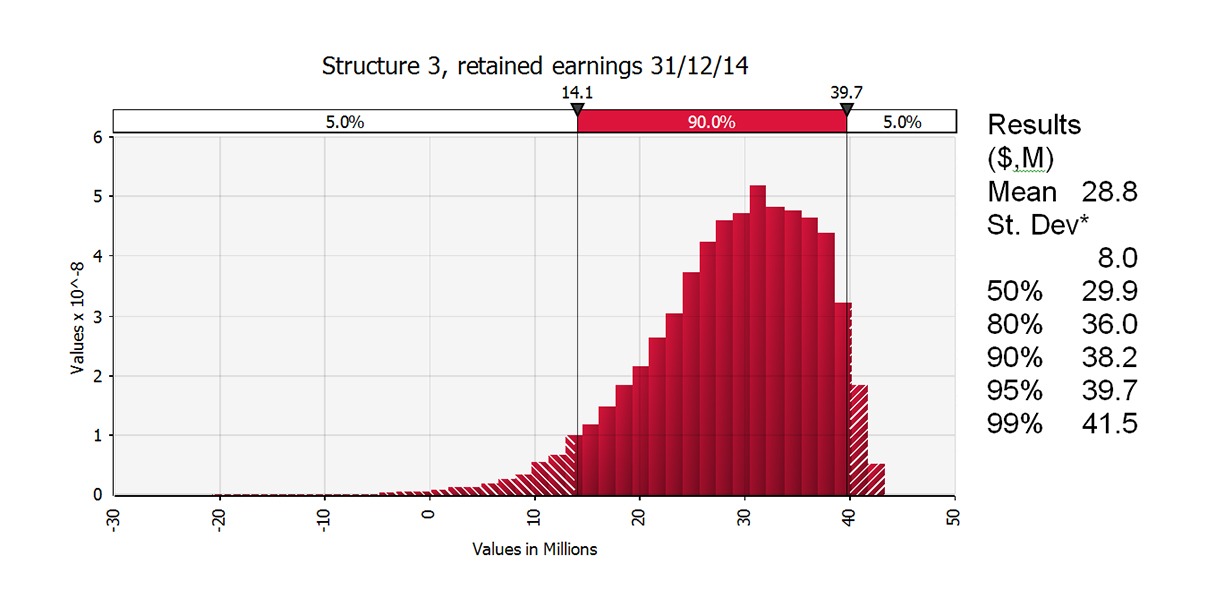

These results are applied through the captive’s financial statements to see the effect alternative reinsurance structures have on premium levels and capital requirements over the next three to five years.

This enables Alesco to advise the client on the optimal insurance and reinsurance programme structure taking into account the premium to pay, and potential cost savings, as well as the organisation’s risk appetite. Alternatively, a client might review its current reinsurance programme ahead of its renewal to evaluate whether it had sufficient capital to increase their retention levels, ultimately reducing their external premium spend.

Complex Modelling Made Simple with @RISK

“The introduction of regulation such as Solvency 2 and other ‘risk based’ capital approaches generally requires this type of risk modelling to validate and support capitalisation levels,” explains Derek Thrumble, Partner at Alesco. “Palisade’s @RISK makes it quick and simple to run Monte Carlo simulations directly in Excel, thereby avoiding the need to build complex models with thousands of rows of data and code. As a result we can undertake complex forecasting for our clients within a realistic time-frame to influence decisions that meets their corporate, financial and legal requirements and determine the insurance strategy that is the best fit for them at that time.”

Additional information

Distributions used:

- For claims frequency, Poisson and negative binomial distributions represent insurance claims counts well.

- For claims severity, heavily skewed distribution such as lognormal and Pareto are used. These provide a good representation of insurance claim sizes and adequately capture the possibly of large catastrophic claims.

- For natural catastrophe risks, output from external windstorm or earthquake modelling software can be directly linked to provide an “empirical” distribution of the impact of these rare but potentially devastating events.

Key software features useful to Alesco:

- The flexibility to expand into more complex structures/products (e.g. multi-year) very quickly. (While annual reinsurance contracts may be relatively straightforward to interpret, the addition of multi-year products will often require a more flexible modelling approach with testing using Monte Carlo simulation.)

- The ability to ‘audit’ results, i.e. it’s not a ‘black box’. The impact of key input parameters on the results can be assessed with detailed sensitivity analysis.

- Powerful output and presentation graphics.

Structure 3 appears “optimal” in terms of maximising retained earnings within the captive at an acceptable level of risk (measured by the standard deviation).