Deterministic, spreadsheet-based risk analysis methods are no longer robust enough for today’s dynamic energy industry, especially for high-stakes decisions like material capital investments, strategic growth analyses, and M&A transactions. Lumivero’s Predict! and @RISK integrate with Microsoft Excel to create a centralized risk ecosystem that allows for dynamic, probabilistic modeling—without sacrificing control of your data, analysis, or decision-making frameworks.

In highly volatile, high-value industries like energy, risk management practices are essential—and often a regulatory requirement. A common organizational failure point is the gap between executives, who need strategic insights, and practitioners, who often view risk management as a mere "box-ticking" compliance exercise.

By implementing the right risk management tools, you can instantly bridge this divide. @RISK and Predict! realign your culture to embrace proactive risk management, ensuring technical analysis directly informs executive decision-making, even in the highest-stakes scenarios.

In a recent webinar, “Predictive Power: Using @RISK and Predict! In High-Stakes in High-Stakes Modeling”, experts Manuel Carmona, Lachlan Hughson, and Glen Justis explained how to go beyond box-ticking with probabilistic risk modeling practices empowered by Lumivero’s Predict! and @RISK risk analysis software.

This article summarizes key insights from the webinar, along with real-world examples of how combining @RISK and Predict! can help energy companies gain more insight from their data and make better decisions.

Shockingly, 42% of businesses still rely only on Microsoft Excel for tracking and analyzing risk, even when making high-stakes capital decisions, according to the “Global State of Risk Report.” As a standalone tool, Excel is simply not suitable for modeling risk in today’s complex and volatile environment. It delivers single-point, deterministic estimates that mask true uncertainty, leading to potentially catastrophic investment failures.

@RISK and Predict! build on what’s best about Excel, giving businesses access to powerful risk analysis capabilities and a quantitative risk analysis (QRA) platform without asking them to surrender control of their data or sacrificing Excel's robust model-building capabilities.

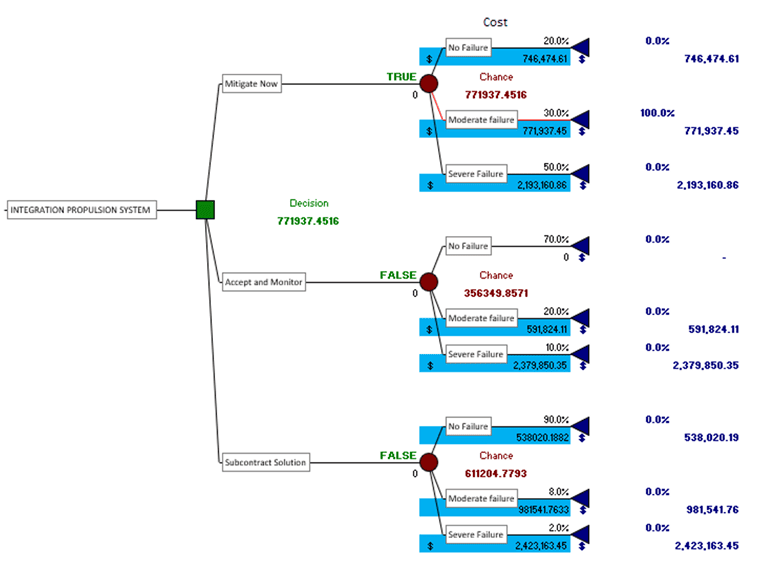

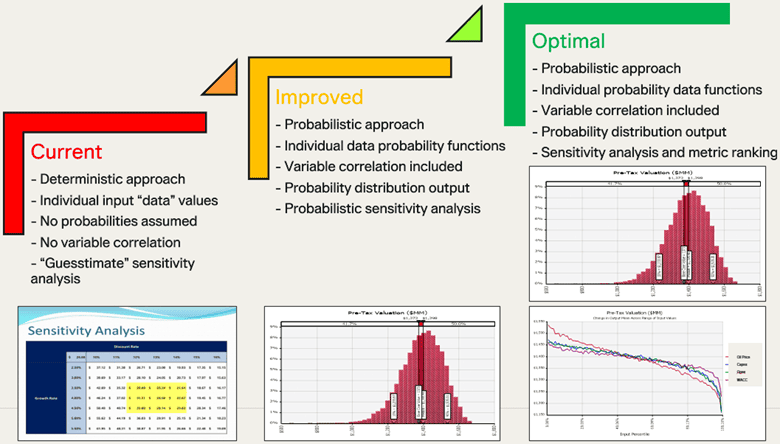

Lumivero's tools help take financial modeling and other forms of risk analysis from a deterministic, spreadsheet-only approach to a probabilistic approach that integrates Monte Carlo simulation tools in @RISK with a centralized risk register in Predict!, plus a wide range of visualizations, such as this decision tree that was developed for a final investment decision discussion:

With the right approach to integrating trusted add-ins like @RISK and powerful, enterprise-wide risk management solutions like Predict!, processes and systems can stay the same while analysis becomes more insightful.

This continuity of control is a key point to make when trying to encourage reluctant executives or practitioners to upgrade from spreadsheets alone to an integrated platform that includes Excel.

@RISK is a Microsoft Excel add-in that puts powerful data analysis tools at your fingertips—notably Monte Carlo simulation tools that allow you to model complex systems and account for uncertainty to produce probabilistic results, such as for cost estimation. @RISK also integrates with scheduling tools like Primavera and MS Project, making it a central risk analysis hub that ensures consistency of your data across projects.

Then, you can pull your risk analysis reports into Predict!—a powerful portfolio risk management platform that creates:

Few scenarios are as high-risk as mergers and acquisitions (M&A). The academics Baruch Lev and Feng Gu reported in a 2024 article for Fortune Magazine that an analysis of 40,000 M&A deals over 40 years found a failure rate of 70–75%.

In the webinar, Glen and Lachlan discussed how companies considering an M&A scenario would need to build multiple Excel models that can only account for two risk factors at a time, and run analyses on each of them, resulting in multiple models with no way to understand which best represents the most likely outcomes.

With @RISK and Predict!, it becomes possible to build a single, integrated model that allows for deeper insights built on real-world data rather than rules of thumb.

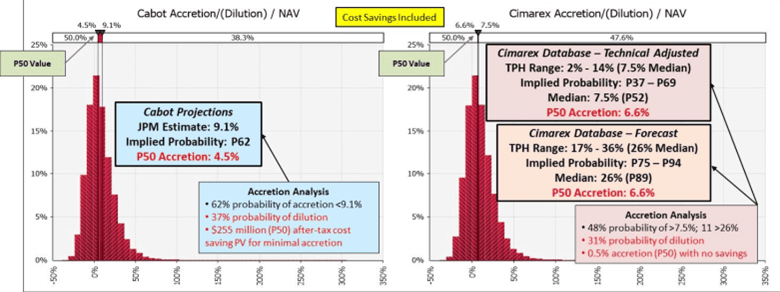

Using probabilistic financial analyses for Cabot and Cimarex, the real-world accretion/dilution value ranges are set out in the graphs below. Including projected cost savings, this analysis provides significantly greater insight into the probabilities associated with projected accretion levels—critical insights a static analysis alone cannot provide.

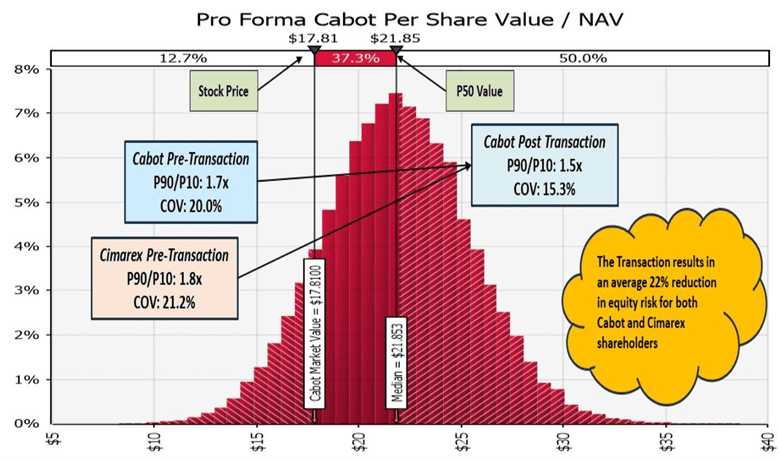

Understanding how shareholder risk changes pro forma versus the standalone position is a critical part of M&A transaction analysis. Using engineering metrics like P90/P10 and Coefficient of Variation, we can now quantify risk shifts that were previously only described qualitatively—again, insights static models simply can’t deliver.

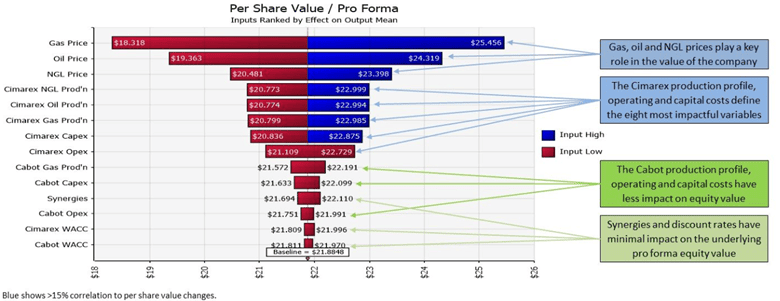

A probabilistic approach also provides unique commercial insights into how operating and financial inputs impact per-share value. A sensitivity analysis, like the one below, helps boards identify the key value-driving levers and sharpen their forward-looking strategies to drive success—another critical layer of analysis not possible with static methods.

For more insights into the graphs in this article, read the full paper, “Enhancing Management Insight into Mergers & Acquisitions Using Probabilistic Financial Analysis.”

Excel-based risk analysis isn’t going away anytime soon—and while AI is gaining ground, its impact is limited in sectors like energy, where insights rely on proprietary data current AI can’t access.

Meanwhile, @RISK and Predict! make it possible to enhance, rather than replace, tried and true risk analysis fundamentals and decision-making processes. By combining them, you can leverage your deep knowledge of how your enterprise operates, create greater visibility of risk, and enhance common understanding of your most critical variables at every level of your business—ensuring greater insight into high-stakes decisions.

Start exploring what’s possible with Lumivero risk analysis tools: request a demo of Predict! and @RISK today.