Monte Carlo simulation is a powerful technique that models uncertainty and risk by simulating a wide range of possible outcomes. It supports better decision-making by showing the probability of different scenarios, rather than relying on a single-point estimate. From capital planning to project scheduling, it helps organizations optimize results and reduce surprises.

Business decisions don’t happen in a vacuum. Markets fluctuate, customer behaviors shift, and countless external factors can throw off even the best-laid plans. When outcomes are uncertain and the stakes are high, relying on gut instinct isn’t good enough. That's why more businesses are increasingly turning to the Monte Carlo method—a sophisticated statistical technique originally developed in nuclear physics.

In this article, we'll guide you through the basics of Monte Carlo simulations, help you understand the core concepts, walk through a Monte Carlo example model, and discuss how to make Monte Carlo distributions work for your business.

Monte Carlo simulations work by using random numbers from defined ranges and behaviors, like the normal distribution with its given parameters (mean and standard deviation), to explore a range of possible outcomes. This technique provides a robust framework for assessing risk, optimizing processes, and ultimately, enhancing decision-making in an unpredictable world

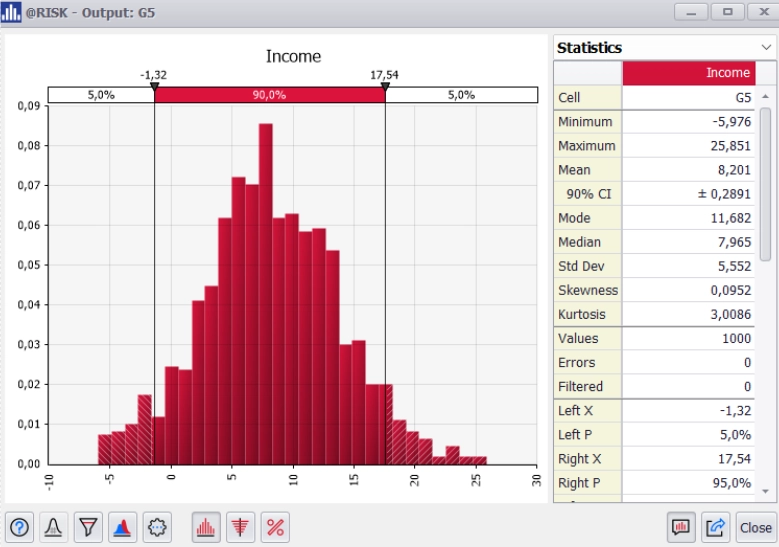

Income probability distribution created using Monte Carlo simulations in @RISK.

Monte Carlo simulations are a class of computational algorithms that rely on repeated random sampling to obtain numerical results. Essentially, they model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables. The term "Monte Carlo" is derived from the famous casino in Monaco, symbolizing the element of change involved in these calculations.

The process works by creating a mathematical model of a system or process, then running multiple simulations (often thousands or millions) with random input variables to see the range of possible outcomes. The results provide a comprehensive picture of the risks and uncertainties involved which can help businesses make more informed decisions. This approach also lets you conduct sensitivity analysis of your inputs to help determine which ones have the most impact on your results.

An early version of the Monte Carlo method dates back to 1777, when French scientist Georges Buffon used a needle-dropping experiment to estimate the value of pi. The modern version, however, emerged in 1946 when American scientist Stanislaw Ulam, while recovering from illness, considered using random trials to solve problems too complex for direct calculation—starting with the odds of winning a game of solitaire.

Ulam and mathematician John von Neumann later refined the technique for use in nuclear research. The method was named after the Monte Carlo casino, reflecting its reliance on chance.

You can read more about the origins of the method from Encyclopedia Britannica and Los Alamos National Laboratory.

In business, uncertainty is inevitable, but it doesn’t have to be a source of paralysis. Monte Carlo simulation helps businesses improve:

Monte Carlo simulations are a powerful tool in risk management software, allowing companies to quantify risk by showing the range of possible outcomes for any given decision. This probabilistic approach can be particularly useful in areas like financial forecasting, project management, and investment analysis. By understanding the probability of various scenarios, businesses can make decisions that are not only based on best-case and worst-case scenarios but also on the most likely outcomes according to the statistical analysis.

Monte Carlo simulations help decision-makers see beyond simple averages. For instance, rather than relying on an average sales forecast, a business can use the Monte Carlo method to visualize a range of possible sales figures based on different assumptions about market conditions, customer behavior, or other factors. This allows for more nuanced and resilient planning.

Whether it’s determining the most efficient supply chain routes or optimizing inventory levels, Monte Carlo simulations can identify the best strategies for minimizing costs while maximizing efficiency. By simulating various scenarios, businesses can compute and test different approaches to see which ones lead to the most favorable financial outcomes, thereby reducing waste and improving profitability.

In project management, delays and cost overruns are common risks. Performing Monte Carlo analysis in project schedules can help model probabilistic project timelines, considering the uncertainties inherent in complex projects. By simulating the project multiple times with different variables, managers can estimate the likelihood of completing the project on time and within budget. This helps identify potential bottlenecks and allows for better resource allocation. To apply Monte Carlo simulation to project schedules, consider using an advanced analysis tool like Lumivero's ScheduleRiskAnalysis.

Monte Carlo simulations are particularly valuable in the financial sector for making informed predictions. When evaluating investments, whether in stocks, real estate, or new business ventures, these simulations can model the potential returns under a variety of market conditions. By considering the full range of possible outcomes, investors can better understand the risk and potential reward, leading to more informed investment decisions.

Before launching a new product, businesses can use Monte Carlo simulation to estimate and predict how the product might perform in the market. By simulating different levels of demand, cost, and competition, companies can adjust their strategy, pricing, or production process before committing significant resources.

Monte Carlo simulation works by assigning probability distributions to uncertain input variables in a model—like cost estimates, resource availability, or demand. Using random sampling techniques, it runs the model thousands (or even millions) of times to explore a wide range of possible outcomes. Each iteration uses a different set of randomly selected values for the uncertain inputs, resulting in a distribution of outcomes that reveals not just the most likely result, but also the best- and worst-case scenarios.

For example, if you're estimating the cost of a capital project, rather than relying on a single number, Monte Carlo simulation can show you the probability of staying within budget—or how likely you are to exceed it—based on realistic variability in materials, labor, delays, and other risk factors. Tools like @RISK, which integrate Monte Carlo simulation in Excel, seamlessly bring this advanced analysis into existing workflows.

Adopting Monte Carlo simulations in your business requires a combination of the right tools, expertise, and a clear understanding of your business objectives. Here’s how you can start:

Begin by identifying the key decision or process you want to improve. Whether it's forecasting sales, optimizing inventory, or managing risk, having a clear goal is crucial.

Monte Carlo simulations are based on distribution hypotheses, so it's important to collect relevant data or to clearly identify the behaviors of the different input variables. This could include historical sales data, cost information, market trends, or other factors that influence the outcome of your process.

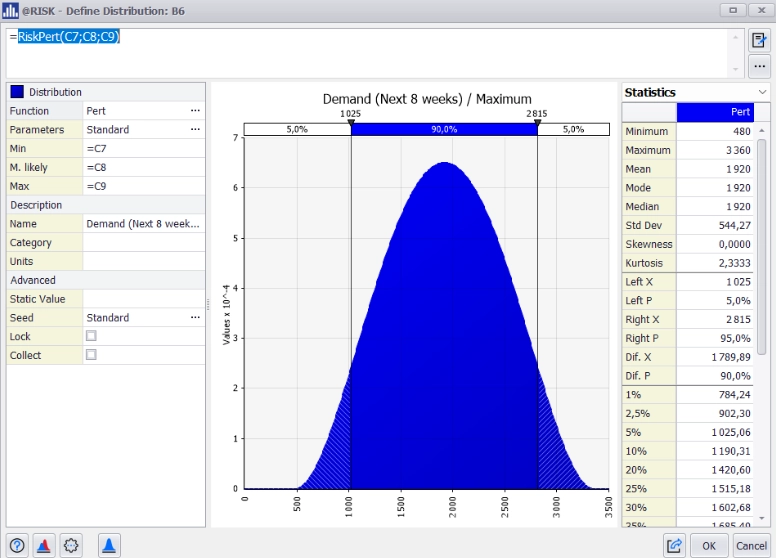

@RISK Monte Carlo simulation model of demand using the Pert distribution function.

Use a powerful risk analysis with Monte Carlo simulation software like @RISK that helps you efficiently build probabilistic risk models by generating random values that deliver insightful and shareable results, all within Excel. The model should include the key variables and their possible ranges of outcomes, represented by a normal distribution which has two parameters – the mean (average) and standard deviation. Watch our introductory webinar to learn more: Intro to Risk Analysis with Monte Carlo Simulation Using @RISK.

Once your model is built, run the simulations multiple times to explore the range of possible outcomes. The greater the number of simulations, the more reliable your results will be – allowing you to estimate outcomes with greater confidence.

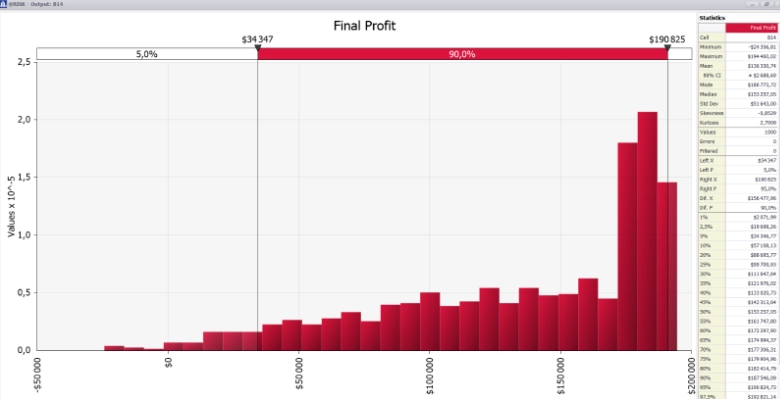

Simulate in the @RISK software interface to generate a probabilistic model showing all possible outcomes.

After running the simulations, analyze the results to understand the probabilities of different outcomes. This will help you identify the risks, potential rewards, and the most likely scenarios.

Final profit graph in @RISK showing the likelihood of all scenarios.

Use the insights gained from the simulations to make informed decisions. Whether you're planning a new product launch, investing in a new market, or managing day-to-day operations, Monte Carlo simulations provide a robust framework for decision-making.

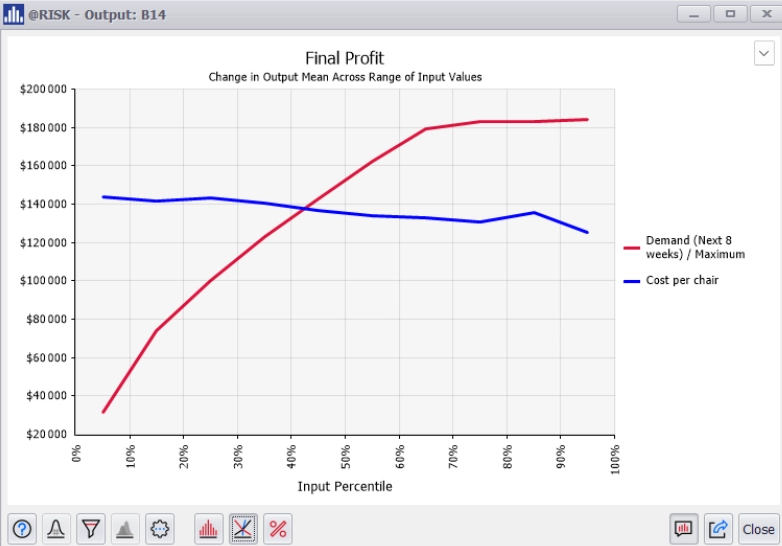

Final profit graph in @RISK showing the impact of the inputs demand and cost per chair on the results.

Monte Carlo simulation captures the full range of uncertainty and variability in inputs, providing a more realistic view of what could happen—especially compared to static models or simple averages.

With a visual breakdown of risk and probabilities, decision-makers can act with greater confidence, knowing the likelihood of different outcomes and where to focus mitigation efforts.

The accuracy of the simulation depends on the quality of the assumptions (including type of distribution) and data fed into it. Inaccurate inputs or oversimplified assumptions can lead to misleading results.

While tools like @RISK simplify the process, some users may still require training to properly interpret distributions, define inputs, or build effective models.

Several industries have successfully integrated Monte Carlo simulations into their decision-making processes.

Banks and investment firms use Monte Carlo simulations to assess the risk of portfolios, model market scenarios, and determine capital reserves. This helps them comply with regulatory requirements and manage financial risk more effectively.

Companies in the manufacturing sector use these simulations to optimize production processes, reduce downtime, and manage supply chain risks. Monte Carlo simulation supply chain models can help forecast demand variability, evaluate supplier reliability, and test the impact of disruptions. By simulating different production schedules and maintenance plans, they can ensure smooth operations and avoid costly interruptions.

Monte Carlo simulations are used for everything from predicting patient outcomes to planning the logistics of large-scale health interventions to determining the best clinical trial sequencing pathway for a new drug. For example, hospitals might use these simulations to forecast patient influx during flu season, helping them to allocate resources efficiently.

Energy companies use Monte Carlo simulations to model the impact of fluctuating demand, pricing volatility, and regulatory changes on their operations. This allows them to make more informed decisions about investments in infrastructure and technology.

Monte Carlo simulation helps project managers deal with uncertainty by modeling time and cost estimates as probability ranges instead of fixed values. Monte Carlo simulation project management models allow teams to assess the likelihood of meeting deadlines, identify tasks most likely to cause delays, and plan more realistic budgets.

For more information, read the article, “Monte Carlo simulation examples.”

Monte Carlo simulations are a powerful tool that can transform the way businesses approach risk and decision-making. By providing a comprehensive view of possible outcomes, they enable companies to make more informed, data-driven decisions.

Whether you're looking to optimize costs, manage risk, or improve project management, incorporating Monte Carlo simulation software into your business processes can lead to more strategic and successful outcomes.

Discover how Lumivero’s decision software can help you gain a competitive advantage today!